- HS3 to result in 36% fall in Liverpool unemployment by 2030 (JLL)

- 82% of Liverpool businesses foresee economic growth over next 5 years (Liverpool Business Survey)

- L1 buy-to-let apartments available from just £68,198 (Property Frontiers)

The Northern Powerhouse report, launched by Transport Secretary Patrick McLoughlin last week, represents the most exciting thing to have happened to the north of England’s railways in decades and analysis from JLL has shown that Liverpool looks set to be its greatest beneficiary.

Looking ahead as far as 2030, the JLL report has projected that unemployment in Liverpool will fall by 36% as a result of the planned HS3 rail network, which will stretch across the Pennines and connect the cities of Liverpool, Manchester, Leeds, Hull and Newcastle. Speeds of up to 140 mph mean that travellers could be whisked from Liverpool to Manchester in as little as 20 minutes.

The impact on Liverpool’s unemployment rate is the most dramatic drop of any of the cities to be connected by the HS3 line, but the good news doesn’t end there. Liverpool John Lennon Airport is also set to improve its travel offering, with plans for a hub link to Heathrow under consideration. If they go ahead, the plans would mean that business and leisure passengers could benefit from access to global flights through Heathrow, with a huge boost to Liverpool’s economy anticipated as a result.

With economic growth being a key driver of a robust property market, the transportation plans are excellent news for Liverpool’s accommodation sector, as Ray Withers, Chief Executive of specialist property investment company Property Frontiers, explains,

“Liverpool is one of the most exciting cities in the north in terms of property investment right now. With the HS3 rail network plans and the hub link between Liverpool John Lennon Airport and London Heathrow, Liverpool is facing increased employment and enhanced prosperity. These factors lead to greater demand for premium housing, so now is the perfect time to invest.”

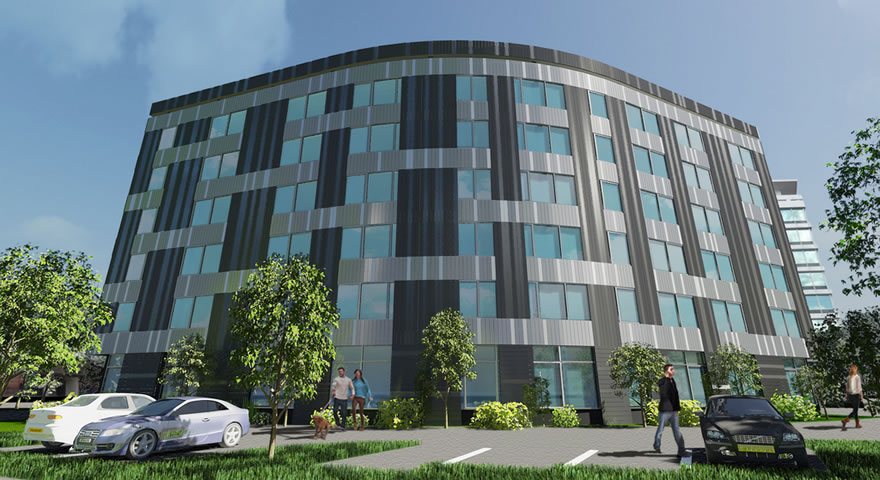

High end apartments such as those at Parker Street are particularly popular with buy-to-let investors looking for the optimum combination of sought after, city centre location and healthy yield. The high spec studios and one bedroom apartments are available from £68,198, with 8% NET yield for cash buyers. Their L1 location ensures that tenant demand is strong and that rental income is thus at a premium rate.

Liverpool has already enjoyed the impact of some transportation infrastructure improvements, with the initial part of the refurbishment of Merseyrail’s five underground loop line stations already complete. The final station to be refurbished, Moorfields, will see work start next month, with the £8 million work completing the overall £40 million of the network’s upgrade.

Improving infrastructure and brightening economic prospects have served to make Liverpool’s businesses much happier and more confident over the past year. The 2014/2015 Liverpool Business Survey found that 76% of businesses scored Liverpool either four or five out of five, with 82% predicting economic growth over the next five years.

Of course, happy companies mean happy workers and happy workers demand high quality accommodation. Thankfully, with developments such as Parker Street bringing in investment and driving up standards in the private rented sector, that is just what Liverpool’s residents are going to get.

For further details, visit www.propertyfrontiers.com or call the team on +44 1865 202 700.