As the ruble falls, Russians look further afield to emerging markets for second property purchases

2014 hasn’t been particularly kind to the ruble. Russia’s national currency has fallen by about 10% since the start of the year, reaching a 5-year low against the US dollar and the Euro earlier this week according to the Central Bank of Russia (CBR).

- Ruble reached a 5-year low on Monday 3rd March 2014 (CBR)

- 88% increase in searches for homes in UAE (Feb – March 2014, Idinaidi.ru)

- Turkey remains the most searched for emerging market on Idinaidi.ru

With policymakers and most analysts agreeing this trend will continue into 2014, not only the stock markets but also potential international property buyers are set to be affected but how?

Historically Russian international property buyers have sought to purchase second homes in popular western locations such as prime central London, New York, Paris and Southern Spain but now, due to the weakness of the ruble, buyers are looking elsewhere to emerging markets where their money will go further.

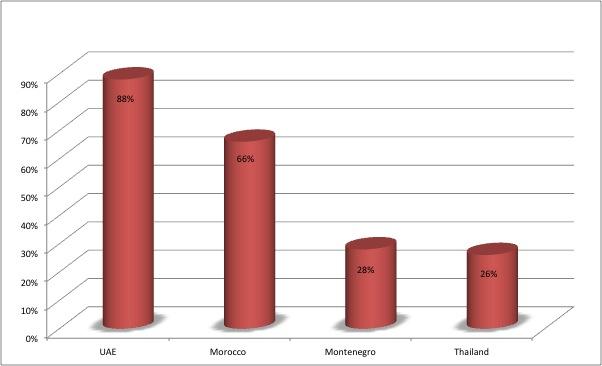

According to the latest data from Russia’s fastest growing international property portal, Idinaidi, the greatest increase in searches for international property destinations outside of these traditional buyer strongholds were for homes in the United Arab Emirates (UAE) up 88% over the last month, Morocco up 66%, Montenegro 28% and Thailand 26%.

With many Russians more affluent than ever, the dream of owning a second home abroad can now become a reality even if you aren’t an oligarch. Further data from Idinaidi reveals that while budgets for traditional destinations often stretch into the tens of millions, more modest pockets can still secure property in emerging destinations.

The average property searched for in Morocco for example was priced at EUR 60,000, rising to EUR 100,000 in the UAE and EUR 150,000 in Thailand.

Turkey, one of the most popular tourism destinations attracting 2.8 million Russians in the first three quarters of 2013 alone, remained the most searched for emerging market on Idinaidi. Search volumes for Turkey were higher than all other emerging markets combined with the most sought after destinations being Alanya, Antalya, Kemer, Bodrum and Istanbul.

Carlo Walther, Founder and COO of Moscow-based Idinaidi, comments,

“The declining strength of the ruble is mainly affecting the Russian international property buying mass market. Buyers are becoming less conservative and as our search levels reveal, we see more Russians interested in cheaper destinations such as Turkey where the currency has also been under pressure.

“These destinations however can´t always compete with more traditional second home markets such as Spain and Bulgaria. Search volumes for these locations is still growing albeit it slower than we have seen in recent months.”

For more information on where Russians are buying property overseas, visit Idinaidi today at www.idinaidi.ru.

Editor´s Notes:

Idinaidi – Property Rental and Sales Portal, Russia

Idinaidi is Russia´s national real estate website and the fastest growing property portal in Russia. It lists sales, letting and new project listings, mortgage information, a question and answer forum, sales price data, a professional directory and a blog, as well as an international property section.

Launched on 1st February 2013, the site has over 600,000 listings and is used by over 7,000 registered professionals in 120 cities. In 2013 the site was used by over 9 million property hunters, and the site currently receives over 1.4 million visits each month.

Idinaidi has the largest direct coverage of the Russian mortgage market, with the direct participation of banks representing 87% of the market. It also boasts the most read real estate blog in Russia, as well as being the most followed real estate site on the country´s social networks.

Russia has a population of 142 million people, 116 million of who live in the European (western) part of the country. It has 38 cities with over 500,000 inhabitants, 13 of which have over 1 million.

For more information visit Idinaidi at www.idinaidi.ru.