Thousands of Brits are believed to have lost deposits put down on holiday homes in Spain over the last decade.

Dreams of owning a second property in the sunshine to enjoy holidays with family or retire to have turned sour, leaving many out of pocket by tens of thousands of pounds.

But hope is not lost, CostaLuz Lawyers, together with “the Erin Brockovich” of Spanish property, Keith Rule, are righting these wrongs having been the first to identify Spanish Law LEY 57/1968 and use it to successfully win over £10 million (€12 million) in lost deposits for their clients.

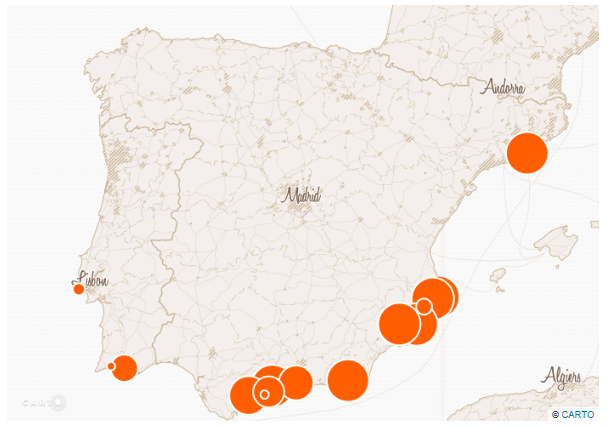

CostaLuz Lawyers has won almost 850 claims in total from Spanish property developers & banks, helping more than 1,500 clients from across the UK and Ireland as well as Spanish and European nationals.

Last week Maria Luisa de Castro, Founder & Director of CostaLuz Lawyers, secured £1 million from Caixabank for nine British families whose homes in Malaga were never delivered. Working alongside DeCastro’s legal team, CostaLuz Lawyers also has around 100 cases still pending outcomes in the Appeal Courts and more than 500 cases still in progress in the First Instance Courts.

If you paid a deposit on an off-plan property in Spain but did not receive a refund, read the below Q&A with Maria Luisa de Castro to see if you can claim:

Q: Am I eligible to recover my lost off-plan funds in Spain?

A: You are if:

- You have a cancelled purchase contract, either by Court decision or by the Bankruptcy administrators of the developer

- Your development was never started or finished on time according to the purchase contract and you have a Bank Guarantee

or:

You do not have an individual bank Guarantee, but you do have a General Guarantee contract signed between developer and the bank

or:

You completed on a property with no First Occupation License—in this case mortgage repayments are also recoverable

or:

You have none of the above but you have copies of all off-plan payments made to the developer’s bank account. Even if you paid your off-plan deposit to a third party i.e. conveyancing Lawyer or Agent, it may be possible to obtain the evidence required on your behalf to enable the Lawsuit to be filed against the developer’s bank.

Q: What am I entitled to claim back?

A: You can claim all amounts paid off plan, plus legal interests normally from the payment dates. Legal costs may also be recoverable in some cases.

Q: Are banks actually paying this money back?

A: Yes, they are. Banks are solvent entities that must comply with the law. All banks with a firm court decision against them are refunding the claimants. Even if the developer’s bank no longer exists, action is still possible against the bank that has taken it over. For example in the Finca Parcs case the developer’s bank was Banco CAM which was taken over by Banco Sabadell so the action is now against Banco Sabadell.

Q: How safe is this action?

A: Supreme Court has already interpreted the full text of law 57/68 in favour of buyers/consumers, so the success rate is very high.

Q: Are banks settling out of court?

A: In a small number of cases Banks do offer settlement out of court, however this is normally only for the principal amount with no interest or costs.

Q: Does this apply if I bought more than one house?

A: It does, as long as you didn’t do so as part of your professional trade. It also applies if the contract mentioned these guarantees explicitly to secure the success of the business.

Q: Does it apply for commercial premises?

A: It does, if the guarantee was offered in the contract

For more information, please contact CostaLuz Lawyers’ UK office on +44 1908 635 111 and speak with Keith Rule. To speak with Maria in the Spanish office, please call +34 956 092 687 or you can visit www.costaluzlawyers.es.