- US property most popular for international investors

- Overseas buyers return to Greece

- The Philippines emerges as rising star of 2016

- Demand for Dubai real estate stays strong

Overseas investors are still in love with the USA, reveals TheMoveChannel.com’s latest Top of the Props report. US property stole back the number one spot from Spain in July 2016, becoming the most sought-after country on the property portal, for the sixth time this year.

American dream still going strong

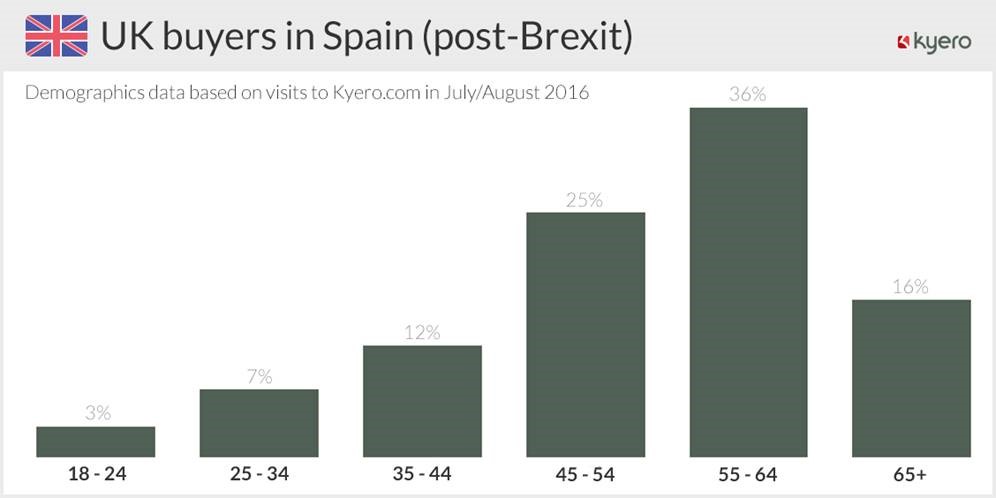

The recent vote by the UK to leave the European Union has seen both the pound and euro weaken against the US dollar, but international investors around the world refused to be deterred from their American dream in the month following the referendum’s result.

US property accounted for 1 in 12 of all enquiries (8.1 per cent) across the month, climbing two places in TheMoveChannel.com’s chart to overtake both Spain and the UAE.

“America’s residential market continues to enjoy strong capital appreciation, fuelled by low mortgage rates, steady employment growth and limited supply,” explains TheMoveChannel.com Director Dan Johnson. “Investors are therefore still turning to affordable markets with high returns, such as Detroit, and perennial hotspot Florida. Commercial property in New York is also a significant driver of demand, thanks to the country’s stable and steady economy growth.”

Europe not down and out

While the UK is preparing to leave the EU, investors have lost none of their appetite for the continent’s real estate. Despite Spain’s slide into second place, enquiries remained strong for European property in July, with familiar favourites Portugal, Italy and France all in TheMoveChannel.com’s 10 most popular destinations.

Buyers returned to Greece, with the country’s share of enquiries hitting a 19-month high in July. As a result, the country climbed five places from 14th to ninth. Interest in Germany is also at a record high, with the country entering the Top 5 for the first time. Bulgaria and Cyprus both entered the month’s Top 15 destinations too.

“The relatively weak euro means that European real estate remains a highly attractive prospect for international buyers, whether from outside the EU or in the UK. Rising values in Spain and Portugal, low mortgage rates in France and the timeless lifestyle appeal of Italy are still drawing investors, while Germany’s growing economy and Greece’s low prices mean property is good value in both countries. Seven out of July’s Top 10 destinations are in Europe; proof that the continent has lost none of its clout.”

Dubai demand stays strong

Away from Europe, demand for Dubai real estate remains strong, with the UAE continuing to move up and down within TheMoveChannel.com’s Top 10 destinations.

According to data from the Dubai Land Department (DLD), British nationals are the third largest group of investors in the city’s property, with experts welcoming the recent price correction for residential property, as the market moves from speculative to end-user investment ahead of 2020’s Word Expo.

“Dubai has become a regular presence in TheMoveChannel.com’s rankings in 2016, appearing five times in seven months,” comments Johnson. “The UAE’s appeal has been boosted by its improving transparency. According to JLL, the emirate is now the most transparent property market in MENA.”

The rise of the Philippines

The Philippines has been another rising star of 2016, with the country re-entering the Top 5 destinations on TheMoveChannel.com in July. This is the third time the islands have appeared in the Top 10 this year.

With both the Philippines and UAE removed from the unfolding EU situation, will they become new favourites for post-Brexit investors, or is July’s rising interest just driven by strong opportunities?

“While Dubai’s residential real estate is on course for recovery in 2017, July’s activity was particularly driven by commercial property,” adds Johnson. “Office vacancy rates are falling and demand for space remains high. Opportunities such as a co-working development in the city are opening up new avenues in the emirate’s economy.”

Ray Withers, CEO of specialist international property investment company Property Frontiers, which has recently brought the Portofino Ocean’s Edge resort to the market, attributes the Philippines’ appeal to the country’s record-breaking tourism figures.

“Demand for high end hotel accommodation in the Philippines has never been greater and the country is racing to increase supply enough to keep up with demand. With high quality new resorts required in key tourism hotspots, international investors are keen to buy into the Philippines now in order to be part of the wave of new construction that is required to service the increased level of visitors. JLL’s finding that the Asia Pacific region is the most improved in the world for real estate transparency has furthered this significant trend of international demand for resort investments in the Philippines.”

Click here to see the full top 40 property destinations for July 2016.

— ENDS —

Notes to Editors

About Lead Galaxy and TheMoveChannel.com

Founded in 1999, www.TheMoveChannel.com is the leading independent website for international property, with more than 1.4 million listings in over 100 countries around the world, marketed on behalf of agents, developers and private owners.

TheMoveChannel.com is one of more than a dozen international property sites operated under the Lead Galaxy brand. Lead Galaxy provides online marketing solutions to thousands of property companies worldwide, focusing on portal listings, email marketing, qualified leads, paid search and social media advertising.

The business is headquartered at 24 Jack’s Place, Corbet Place, Shoreditch, London, E1 6NN.

——————————-

Do you need comment or statistics for an international real estate article? Our experienced editorial team and management are happy to collate data, provide example properties, or offer insightful comment to support your publication.

Please contact Ivan Radford on ivan.radford@themovechannel.com or +44 (0)207 952 7221

——————————-

Sign up to our Daily International Property Newsletter:

– Daily updates on property market news headlines

– Quirky stories from around the world of property

– Hot properties being launched internationally

– Useful guides, surveys, research and trends

– Gossip, lists and other property chit chat

Sign up here: http://www.themovechannel.com/my/subscriptions/

——————————-

Feature property listings in your publication!

Our technical team has developed a great new solution for content publishers that allows the addition of high impact advertising units, which can be configured to show property listings, relevant to a type of property, country, region or a specific location.

There are 2 types of implementation:

- Standard Ad Units: These show in 120,600, 160×600, 300×150, 300×250, 300×500, 300×750 and 728×90 formats, with a varying number of listings showing in each version.

- Dynamic Portfolio: This is a completely configurable panel, where you can choose the number of columns and rows, plus the size of the listings and dedicate a section of a page, or even a whole page to a set of properties.

Please contact Ivan Radford on ivan.radford@themovechannel.com or +44 (0)207 952 7221