- Ilford town centre designated as new London Housing Zone (GLA)

- Ilford property values rise 24.53% in 5 years (Zoopla)

- Housing Zones driving investor interest in London (Surrenden Invest)

London’s Housing Zones are areas that have been identified as part of the Mayor’s Housing Strategy as locations that are in desperate need of new housing and which have high development potential. The Housing Zones have created a new way to speed up house building in the capital. They have also acted as a magnet for property investors keen to be part of London’s rapidly evolving future.

According to data presented by BBC Inside Out, London needed more than 250,000 new homes built from 2011-2014, yet actual build numbers languished almost 100,000 units below that target. It’s a disparity that Londoners are all too familiar with and is one of the reasons that prices in the capital have risen to steeply. The situation is such that Rightmove predicts that the average London home could reach a price tag of £1 million by 2020.

Jonathan Stephens, Managing Director of Surrenden Invest, observes,

“London’s Housing Zones have been designed to speed up the rate at which new property is built and brought to market. The city’s housing crisis needs urgent attention and this is one way in which the Mayor’s Office is seeking to help alleviate the situation. It’s a smart move that looks set to benefit Londoners in each of the designated zones. At the same time, it has captured the attention of investors by flagging up areas with outstanding potential.”

Ilford, in the borough of Redbridge, is a great example of one such area. Already a well-resourced, family-focused area packed with shops and restaurants, Ilford town centre is set to benefit hugely from its new Housing Zone status. New homes will see up to 4,000 construction jobs created, with Helen Coomb, Redbridge Council Cabinet Member for Economy, Regeneration and Planning Councillor, commenting,

“Receiving this funding is great news for Redbridge and will allow us to deliver much needed housing in the area. This level of investment from the GLA will bring improved transport along with the arrival of Crossrail and new jobs will boost the local economy and provide great new facilities for our community.”

Plans for those facilities have already reached a value of £1 billion, including work to improve Crossrail stations such as Seven Kings and Ilford, street improvements, the enhancement of open spaces and town centre regeneration work.

Ilford is certainly an area that is welcoming new development. Property values there have risen by 5.71% in the last year, according to Zoopla, and by 24.53% in the past five years, as the lack of new housing and the Crossrail effect in this popular location have served to impact on the market. Of all the areas set to benefit from Crossrail, Jones Lang LaSalle has projected that Ilford will lead the way in terms of price growth.

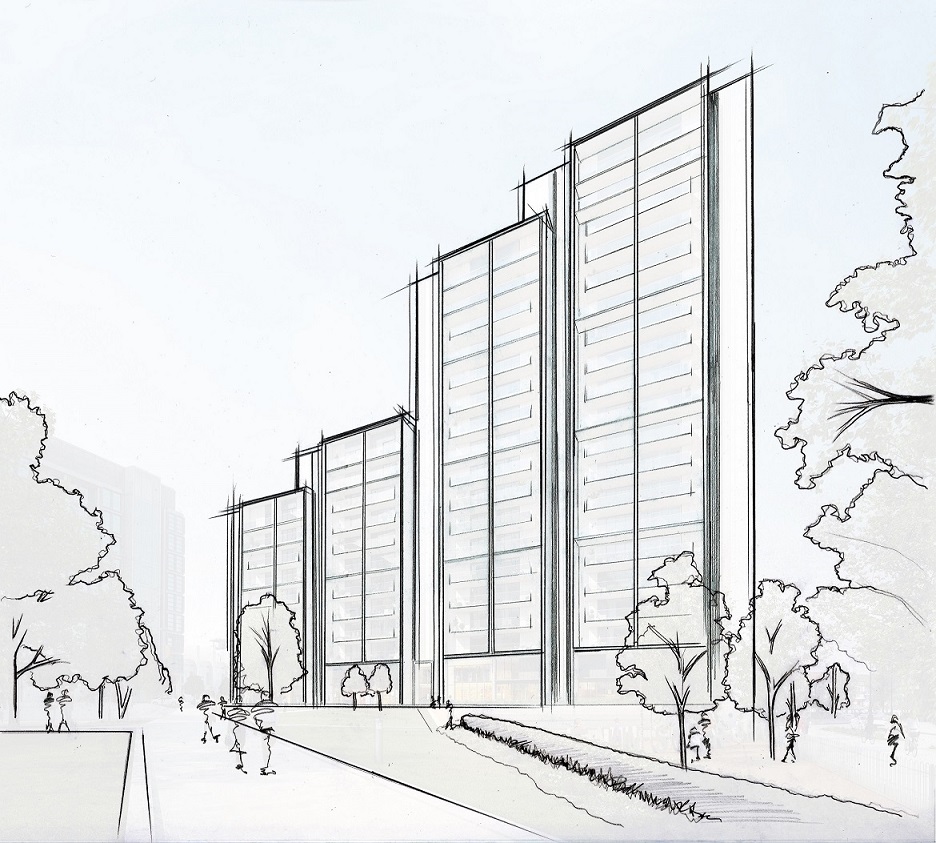

All of this is great news for those investing in the housing schemes that are being developed. One of the latest in Ilford is Horizon Ilford, a mixed use building including studio, one, two and three bedroom apartments. The sustainable design includes green ‘living’ walls, photovoltaic cells on the upper levels, rainwater harvesting and a centralised heating system that combined with smart design will ensure that less heat escapes from the building, lowering energy consumption and reducing residents’ energy bills. It’s being hailed as a sustainable building for a sustainable community.

Just a short walk (5-7 minutes) from Seven Kings station and a slightly longer stroll (10-12 minutes) from Ilford station, Horizon Ilford is certainly well within the Crossrail catchment area. It’s also ideally located for good local schools, shops and restaurants. Investment will include a 15% down payment, with the balance due on completion some two years from now.

For further details, visit www.surrendeninvest.com, email info@surrendeninvest.com or call 0203 3726 499.