- Property Frontiers flags up reduction in low risk returns in emerging markets

- Investors will need to think laterally when it comes to profiting from UK and US cities

- Dark tourism, pockets of growth in Asia-Pacific and hidden European locations all set to deliver in 2018

With 2018 fast approaching, it’s the perfect time for a detailed and well analysed look at what the future is likely to hold for the residential property investment sector. As such, the property investment experts at Property Frontiers have looked ahead to what the next 12 months are likely to hold.

“2018 is going to be an interesting year for property investment. Investors are facing a less bountiful environment, with plentiful, low risk returns in emerging markets drying up to a certain extent. What remains is a harder investment environment, but one that is potentially more rewarding. 2018 is likely to be a year that fortune favours the brave. A flexible strategy, open mind and hard-working property investment company will be the keys to success in the year ahead.”

Ray Withers, CEO, Property Frontiers

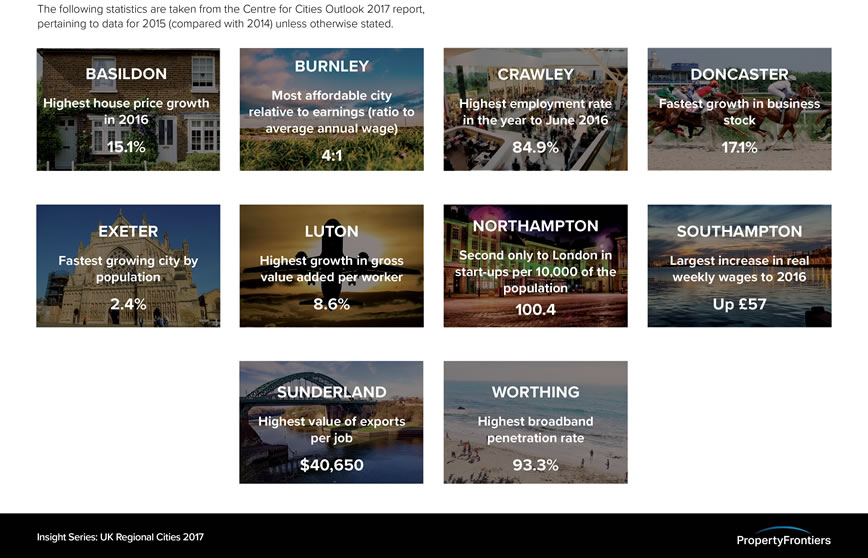

In the UK and the US, it’s time to head off the beaten track in search of up-and-coming towns and cities that investors have barely heard of. These hidden pockets of growth will unlock the secret to healthy returns, while sheltering investors from oversupply in larger cities. Bradford, Doncaster, Exeter and Halifax are all strong contenders in the UK, while in the US it is locations like Pittsburgh, PA, Columbus and Cincinnati in Ohio and Seattle, WA that are most likely to offer some exciting opportunities. Perennially popular tourist areas such as Florida and the Caribbean also look set to fare well, with places affected by 2017’s severe hurricane season potentially offering incentives to investors, as construction companies step up with innovative weatherproof offerings.

Looking to Europe, the 2018 investment picture offers a range of opportunities. Mainstream city markets look stable but not overly exciting, with the exception perhaps of Berlin, Madrid and Amsterdam, which all look set to soar. Leeuwarden in the Netherlands should do well in 2018, thanks to its forthcoming European Capital of Culture designation, while Hamburg and Frankfurt in Germany are also worth a hard look. Sweden’s housing market seems poised for stagnation, though the office market in Stockholm could make for some exciting opportunities. Over in Portugal, the city of Porto is drawing investors’ interest away from Lisbon, while the golden visa schemes there and in Cyprus should continue to pull in plenty of investments.

“Asia-Pacific is looking particularly exciting for 2018, with Singapore, the Philippines and Thailand all looking strong. Japan is also a market to watch very carefully. Growth may be low to middling at present, but with property there 18% undervalued relative to rents, there could be some exciting catch-up growth over a relatively short period. Mongolia is also one to keep an eye on, with projected economic growth of 8% per annum (according to APIP) and some strong foundations for sustainable growth.”

Ray Withers, CEO, Property Frontiers

In Africa, the longer-term gains are key to investment success. The continents’ population is set to double to 2.5 billion by 2050, creating one of the biggest housing challenges/opportunities that the world has ever experienced. The political situation in Zimbabwe is one to watch carefully, while peaceful Ghana, economically powerful and urbanising Tanzania, the dynamic and fast-growing Ivory Coast and stable and culturally-rich Morocco are all likely to present interesting longer-term opportunities.

Over in the Middle East, Saudi Arabia is the one to watch. Crown Prince Mohammad bin Salman is making a name for himself with bold, modernising gestures. The launch of the hugely ambitious Neom, a revolutionary robot-serviced desert utopia backed by $5bn of Saudi cash, is a great example. On a more fundamental level, with women set to be allowed to drive by June (hopefully), the impact on the Saudi property market could be significant. Suburban living will be unlocked to countless previously city-confined families, reshaping the market (and society) in many healthy ways.

“The final mention for 2018 predictions is a nod to dark tourism. Chernobyl’s exclusion zone has seen a 411% rise in visitor numbers since 2009, while Iraq is expected to receive 1,136,000 international tourist arrivals over the course of 2017. Those arrival numbers are expected to more than double over the next decade, according to the World Travel & Tourism Council, creating some exciting investment opportunities thanks to the sector’s rapid rate of growth.”

Ray Withers, CEO, Property Frontiers

All in all, 2018 looks set to be an interesting year indeed for those with a nose for high yielding property investment opportunities around the world!

For more information, contact Property Frontiers by visiting www.propertyfrontiers.com or calling +44 1865 202 700.